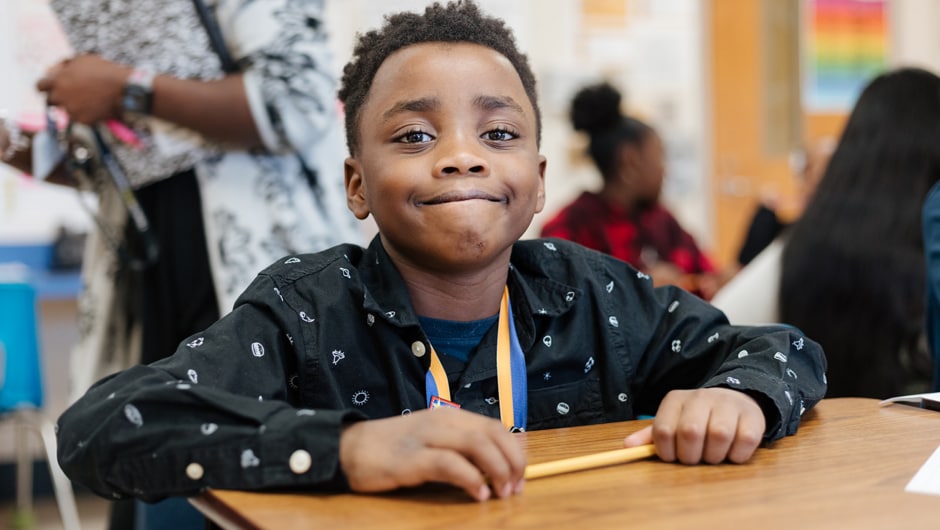

Help us reach the day when all children have access to a quality education by supporting Teach For America.

Planned Giving at Teach For America

There are many ways to leave a lasting impact on the movement for educational equity and excellence. When you make a gift through your estate, you are often able to make a bigger impact than you ever thought possible. Teach For America’s legacy gift planning options include retirement plan assets, life insurance policies, bequests, and trusts. Please read our gift planning options below, or download our estate planning guide to learn more about your options.

One simple way to leave a legacy at Teach For America is to include our organization in your will. If you do not yet have a will, consider creating one online. FreeWill is a free tool that guides you through the process of creating a legal will online or documenting your wishes to review and finalize with an attorney near you.

Once you have arranged a gift, please let us know. We would be honored to have the opportunity to thank you. We would also like to make sure we can fulfill your wishes, while respecting your confidentiality.

If you have any additional questions we didn’t answer here, please reach out to giftplanning@teachforamerica.org or call (917) 836-2001.

Giving Options

A charitable bequest is when someone designates a specific amount of money or assets to a charity in their will or revocable trust. This planned gift allows individuals to support the causes that matter most to them and leave a lasting philanthropic legacy.

How It Works

You can provide a legacy gift to Teach For America by including a bequest provision in your will or revocable trust. Teach For America will receive your gift upon your passing based on the specifications included in the provision.

There are a few different types of bequests:

- Specific: A certain dollar amount or a particular asset. Example: “The sum of $20,000” or “100 shares of ABC stock.”

- Residual: Once other assets have been distributed. Example: “Fifty percent of the rest, residue, and remainder of my estate.”

- Contingent: Only under certain conditions. Example: “In the event my spouse does not survive me.”

Sample language to include Teach For America in your will can be found in our estate planning guide.

Benefits

- The assets remain in your control during your lifetime.

- You can modify the bequest if your circumstances change.

- The value of your bequest should be fully deductible for estate tax purposes.

If you have any additional questions about your bequest, please email giftplanning@teachforamerica.org or call (917) 836-2001.

Leaving retirement assets as part of a planned gift to Teach For America involves designating the organization as a beneficiary of your retirement accounts, such as 401(k) or IRA, in your estate planning. This thoughtful, tax-efficient decision not only supports our work in education but also maximizes the impact of your philanthropy.

How It Works

You can name Teach For America, Inc. as the beneficiary of the remainder of your IRA, 401(k), or other qualified retirement account. The plan's balance will be available for Teach For America’s use when the assets held in the account are transferred.

Benefits

- Most people do not use all of their retirement assets during their lifetime, and those unused assets can be used to fund your legacy.

- You should pay no income or estate tax on the property remaining in your retirement account when it passes to Teach For America.

- You may continue to take withdrawals from the account during your lifetime.

If you have any questions about retirement assets, please reach out to giftplanning@teachforamerica.org or call (917) 836-2001.

Designating Teach For America as the beneficiary of a life insurance policy in your planned giving ensures a lasting contribution to our nation's students. This decision allows you to support our mission, create a meaningful legacy, and have a positive impact on future generations.

How It Works

You can make a future gift to Teach For America by naming "Teach For America, Inc." as the owner and beneficiary of a policy insuring your life. To make a gift of life insurance, you make annual gifts in the amount of Teach For America's premium payments. Once the policy matures, the proceeds are paid to Teach For America and used to help fund our programs.

Benefits

- Allows you to make a substantial gift while the cost to you—your premiums—is relatively small.

- The gifts offsetting Teach For America’s premium payment should be fully deductible for gift tax purposes. You should receive an income tax deduction for the full value of such gifts—subject to certain limitations based on yearly income.

If you have any questions about making a future gift to Teach For America using a life insurance policy, please email giftplanning@teachforamerica.org or call (917) 836-2001.

Supporting Teach For America through a planned gift in the form of a trust ensures a lasting impact on education. By incorporating Teach For America into your trust, you not only foster positive change in students' lives but also create a meaningful legacy that aligns with your philanthropic goals.

How It Works

By establishing a trust and designating Teach For America as the beneficiary, you create a meaningful and enduring gift while also enjoying benefits for yourself and/or your heirs.

There are various specialized trusts, such as Charitable Remainder Unitrusts, Charitable Remainder Annuity Trusts, and Charitable Lead Trusts, where Teach For America can be named as the beneficiary. Additionally, Teach For America can be designated as an alternative beneficiary in trusts primarily benefiting family members or others, receiving the trust property only if the primary beneficiaries are no longer living.

For more details on making a gift through a trust, and to explore the advantages of different trust types, we encourage you to work with your legal counsel and/or accountant and reach out to us to discuss the terms of your planned gift.

Please note that we are unable to serve as a trustee.

Benefits

- Setting up a charitable trust can help you reduce tax liability, allowing you to give more to the charities and people you love.

- You may not be taxed on income earned by the trust. Other tax benefits vary, and you should ask your legal counsel for more information.

If you have any questions about trusts, please reach out to giftplanning@teachforamerica.org or call (917) 836-2001.

Refer to the following info as needed for initiating any of the legacy giving options above.

- Official Name: Teach For America, Inc.

- State of Incorporation: Connecticut

- Principal Place of Business: 25 Broadway, 12th Floor, New York, NY 10004

“One day, I will look back on educational inequity as a thing of the past and feel proud of the role that TFA played in ending it.”